Chatbots for Wealth Management: Augmenting Wealth using AI Technology

-1.jpg?width=960&height=502&name=Linkedin+%20Twitter%20(1)-1.jpg)

It is no secret that AI-powered intelligent chatbots are on the rise. In fact, in a recent Statista study, by 2024, the global chatbots market will expand beyond $994 million. McKinsey Global Institute found that by 2020, companies will have spent $1 trillion to invest in artificial intelligence (AI) technologies. Wealth management chatbots, powered by conversational Artificial Intelligence (AI) and capable Machine Learning (ML) algorithms, can be useful instruments that impact a variety of wealth management use cases and operations.

This article will discuss various use cases where chatbots are useful and how they can make a difference in wealth management services. We explore how chatbots are shaping the future of wealth management businesses by engaging customers in a meaningful way and providing accurate resolution to their queries . They proactively suggest portfolio choices and investment advice that could help customers achieve their long-term financial objectives.

Why are Chatbots crucial for Wealth Management?

The Challenge

Let us understand a few challenges for wealth management companies in 2021 and beyond. Wealth management firms are under much pressure to adapt to a changing world. The way investors access wealth management services has changed. They are increasingly using online chat to connect with companies. At the same time, it’s becoming difficult for firms to stand out through these interactions by differentiating their service offerings.

Financial advisors face challenges in providing quality advice to clients with the increasing complexity of financial products and services. They need to understand the client's needs, analyze their spending capabilities and assimilate an expanding amount of information for them. Doing it promptly for a significant number of investors is a huge challenge. So, this model is no longer scalable.

The third challenge is to ensure fraud-prevention and reduce vulnerabilities to financial risks. This aspect is critical for both - the customers and the wealth management companies.

The Answer

As the AI and ML capabilities evolve to be more powerful, chatbots' adoption for wealth management use cases brings unprecedented results. These technology capabilities help manage the conversations between the wealth management firms and customers and ensure the investment that brings optimum results. The wealth management chatbots help firms address the upcoming challenges effectively.

Wealth management is an area that benefits significantly from the data analysis. Its scope includes examining a client's financial situation, advising about the best course of action for creating or preserving wealth, and then acting as a steward for their finances. From understanding the performance of investments to predicting their future performance, data can help ensure effective portfolio management. Chatbots can analyze a vast amount of data continuously and generate insights that provide effective answers and guidance to individual customers. They also don't have any restrictions on the number of simultaneous conversations they can have with investors. Thus, they enable the dissemination of relevant information to a large customer base easily.

Such analysis also presents opportunities for personalization. By identifying unique investment options and portfolio strategies for individual customers, wealth management chatbots can create offers that are highly relevant and beneficial to each customer. Such personalization increases the chances of conversion and provides the companies with a competitive edge.

Chatbots also help you deal with the third challenge. The algorithms also provide ways to identify and prevent frauds and mitigate risks by analyzing historical data and matching patterns. Through Predictive Analysis and Anomaly Detection algorithms, they protect the customers as well as the companies from frauds.

Let us see in detail various areas of wealth management operations that can benefit by adopting chatbots to serve a variety of use cases.

Read Case Study: How Haptik helped IIFL reduce its Operational Cost and Improve Customer Experience

Areas of Application

Wealth management use cases can be divided into four major areas; marketing, transactions, engagement, and customer service.

The marketing area deals with acquiring new customers and enabling new products for existing customers. The specific activities include finding prospects, generating leads, and converting the leads into customers. The marketing activities also include acquiring referrals to new prospects from existing clients.

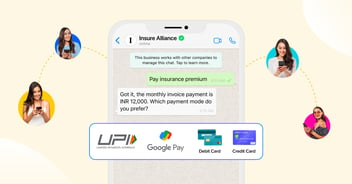

The transactional use cases enable carrying out actual transactions, including purchasing new investment products and plans, executing trades, and facilitating other transactions for existing products. Customers also adjust asset allocation portfolios based on evolving risk profiles and new investment opportunities.

Customer engagement use cases include answering to customer queries and clearing their doubts about products and portfolio strategies. It also involves educating the customers through curation and distribution of financial information regularly. Customers also need and appreciate periodic portfolio updates and details about positions, cash, risk units, industry exposures, correlations to existing holdings, among others.

Finally, the customer service scenario deals with uncovering personalized investment ideas for customers and working as a customer advisor. As customers are getting comfortable with the use of chatbots across various industries, they find more value. The chatbots are also versatile to identify the situations where a human is required or better suited to help the customer and ensure a smooth hand-off. These capabilities have enabled organizations to provide valuable customer support without expanding their workforce unsustainably or raising operational costs.

While these are just indicative and not exhaustive lists of use cases, smart chatbots can positively impact each of these areas. Let's go into the details of the value chatbots can bring for various use cases.

The Marketing

Chatbots provide a low-friction experience that can help start the initial conversation with the customers. The natural language interface of chatbots breaks the communication barriers and quickly starts the discussion with the customer.

This experience is because of the omnichannel capabilities of chatbots. You can make the bots available across all digital touchpoints, including web, mobile, social media, emails, and even wearable devices. The omnichannel capabilities of chatbots allow you use the bots for nurturing and onboarding, which eventually helps in generating more leads and maintaining higher satisfaction levels with your customers.

The personalization capabilities help in engaging the customers quickly. Personalization allows wealth management chatbots to fulfill a customer's individual needs. These capabilities ensure that the customer is satisfied with your service and immediately come up with something they are looking for.

A personalized experience cannot be offered by humans alone, as it requires a lot of data mining, which is time-consuming and costly. With chatbots, you will get a better experience through conversational analytics because they can react to different situations without delay in understanding the context of their concern. The immediate availability of insights and information makes it easier for the bots to provide answers and engage the customers.

As the chatbot integrates with various applications and services, it can automatically create and process the existing customers' network graph. With network graph processing, you can identify new prospects through better targeting and retargeting. Through such recommendations and referrals, you have a better chance of winning over other potential customers..

Engagement

Chatbots are an excellent tool to engage customers in a meaningful way, to provide sensible answers to their questions, and to proactively suggest portfolio choices and investment advice that could help them.

They achieve this engagement by understanding the language a customer uses, including tone, and using advanced Natural Language Understanding (NLU) algorithms. NLU helps them know what their customers want and provide them with tailored recommendations accordingly. They can parse a question, understand the intent behind it, and determine the best way forward. Bots use different data types, including videos, images, text, and audio for communicating the information to customers.

Chatbots also learn continuously from customer interactions. Using this learning, they improve over time on their own to answer more complex queries with higher accuracy.

Transactional Services

As chatbots can automatically monitor the incoming data, they can keep a keen eye on how every customer's funds perform. With the help of predictive ML algorithms, they can also identify the trends various options will follow in the future. By combining the analysis with prediction, the chatbots can inform the customers and financial advisors if their asset allocations need a change. They can also recommend any additional investments, if required to mitigate the risks.

Beyond the analysis and predictions, they can also carry out the actual transactions based on customers' or wealth managers' instructions. They can also be programmed to carry out certain transactions automatically based on the risk profiles and probabilities. Such capabilities allow the customers' and wealth managers' to ensure that their investments are safe against the short and long-term financial volatility, while still optimizing the investments for best returns. The Financial Brand estimates that AI can save more than USD 1 trillion by 2030 for banking and financial service companies, with over 22% reduction in operational costs.

The transactional capabilities of a wealth management chatbot help both the customers and the advisors with a self-service mechanism that allows quick manual adjustments. If the customer quickly wants to adjust asset allocations for their portfolio, they can do it any time of the day from anywhere in the world.

Customer Services

Customer service is where chatbots have already established their utility and benefits through better customer services across industries. A wealth management chatbot can provide the best of both worlds, with customer service and self-service capabilities. It can help customers understand their current situation and make smart decisions about their investments. The benefit for companies comes from improved customer experience while providing administrative assistance on a cost-effective basis. The customers already have the mindset to utilize chatbots for wealth management. An Accenture study found that over 80% of 33000 financial service clients are ready to rely on chatbots for their investment-related transactions.

Personalization

The real power of bots for customer service comes from personalization. By understanding each customer's financial goals, risk profiles & appetite, and current financial situation, the bots can recommend personalized actions, including revised asset allocation or new investments. Such personalization increases the probability of better returns for the customers, thus increasing the trust between the wealth management companies and the customer.

Education through Gamification

Another exciting application that chatbots support is customer education through gamification. While the use of text, images, audio, and video for information distributions to customers by bots is prevalent, gamification provides even more tremendous help. With gamification, chatbots help educate customers on a plethora of complex investment and portfolio performance scenarios in an easy-to-understand manner.

Advisory Services

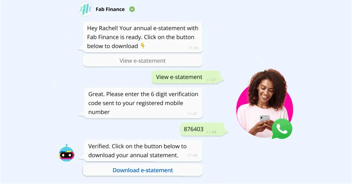

There is another aspect of customer services, which is the advisory role that wealth management chatbots can play. The chatbots can enquire users on desired outcomes, risk tolerance levels, time horizons for retirement or other goals, current investment balances, and allocations. The chatbot will then recommend a portfolio that reflects those inputs and estimates its expected performance over various periods to generate an appropriate plan. Such insights provide the customers with an opportunity to make better investment decisions.

For critical investment decisions, the customers may want to further speak to a human agent to further refine their wealth management strategies. Even in such cases, chatbots are useful.

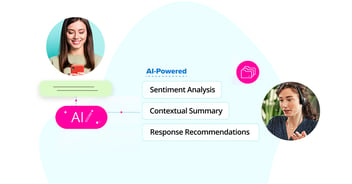

At Haptik, our wealth management chatbot enables a smooth hand-off between the bot and a human advisor. Such hand-off includes making the conversation history and other relevant information seamlessly available to the advisor to provide contextual and personalized investment and asset management advice to the customers.

Apart from acting as advisors, wealth management chatbots assist human advisors by acting as their second pair of eyes on everything from spotting errors that could lead to significant losses and help ensure compliance by scanning documents for red flags related to any suspicious and doubtful activities.

Chatbots are a great way to solve the challenge of scaling human interactions. They can be available 24/7, providing the same service with no lag or latency whatsoever. Chatbots do not require sleep, and as such, they never tire, which means customers always get a high-quality experience.

Read More: 9 Best AI Chatbots in the Financial Industry

To Sum Up

As the wealth management and financial services industry changes, so do the needs of its customers. Asset managers are challenged to transform their businesses to attract and retain clients and create new products and services. Customers are demanding more personalized services, and they expect to manage their assets from anywhere via online and mobile channels.

With the rising chatbots adoption, the technology is opening up new avenues for the financial services sector. Wealth management chatbots, powered by conversational Artificial Intelligence (AI) and capable Machine Learning (ML) algorithms, can be useful instruments that impact the future of wealth management companies.

Recent years have seen the use of chatbots for a wide range of applications, including customer service and sales. This adoption has caught the attention of the financial services industry and many companies have started experimenting with how chatbots can ease wealth management challenges. With capable chatbot platforms like Haptik it is easier now to adopt the chatbots for wealth management. Our Smart Skills provide ready implementation templates for various use cases to augment and grow your wealth management services. All you need is to take the first step.

Want to develop an Intelligent Virtual Assistant solution for your brand?

.jpg?quality=low&width=352&name=blog-banner-2%20(1).jpg)

.png?quality=low&width=352&name=Untitled%20design%20(31).png)

.png?quality=low&width=352&name=LinkedIn%20(9).png)

-1.png?width=352&name=BlogHeader2%20(3)-1.png)

.png?width=352&name=image%20(18).png)

-2.png?quality=low&width=352&name=image%20(11)-2.png)

-1.png?width=352&name=LinkedIn%20(1)-1.png)

.png?quality=low&width=352&name=LinkedIn%20(3).png)

.jpg?width=352&name=sentiment%20(1).jpg)