Credit Card Chatbots: How They Ensure Amazing Benefits For You

As customer experience becomes one of the primary drivers of growth, banks, and financial services institutions are increasingly looking at innovative technology solutions to simplify customer journeys as a strategic tool for growth. Conversational AI is making a mark as a primary agent of change as banks attempt to increase customer satisfaction while making their processes more efficient.

Conversational agents (Chatbots) have been helping banks save a precious 4 minutes per customer interaction. By 2022, these bots will power more than 90% of all banking interactions, including those related to credit cards. Even now, Credit Card chatbots are powering the entire life cycle of customer use, from application to payments.

Credit Card Life Cycle

Irrespective of the type of business, there are five primary stages of a customer life cycle; reach/awareness, acquisition, conversion, retention, and advocacy. From the perspective of credit card customers, banks/financial institutions and customers need to perform the following activities for each of the above phases;

Reach/Awareness

This stage is where a prospective customer becomes aware of various credit card services by a bank/institute and the benefits a credit card brings to them. To drive home the point, banks can also share special offers for customers to obtain the card.

Acquisition

If the cards' availability and offers make the customers interested, the next stage is to capture this interest. This interest becomes a lead that banks can then pursue to win over a prospective customer. Banks can ensure the customers' interests by providing more nuanced information, including each type of card's benefits. These benefits include rewards and cashback, loyalty programs, and any other incentive a customer gets by availing of the card. Based on this information, the customers would either make a preliminary application or provide the contact information so that a bank can reach out with more details.

Conversion

If the customer is convinced about the benefits and applies for a credit card, the bank needs to get the required document to ascertain the eligibility. Banks also need to calculate the customer's creditworthiness and ensure there is no fraudulent or inaccurate information. If everything is alright, the banks then issue and activate the card.

Retention

Customer retention involves two different aspects for the bank; they need to ensure that they are making profits from the credit card operations while ensuring that they do not go away. From the operational perspective, once the customers start using the card, banks need to keep track of spending and invoice the customers at predefined intervals. They need to send payment reminders until the customers pay. The banks need to conceptualize and convey continued rewards and benefits to the customers on the retention front.

Advocacy

One of the critical phases of the consumer life cycle is continued loyalty and advocacy, where the customers become your brand ambassadors and growth agents. This stage is where your loyalty initiatives, including referral programs or enhanced credit limits for better customers, can ensure your customers become your advocates.

Cross-cutting Concerns

Apart from these lifecycle stages, certain events may happen anytime during the life cycle. Primary among them are users losing the cards or defaulting on the payments. In both cases, the banks may have to block the existing cards. Apart from this, there might be customer inquiries, statement requests, or requests related to adjusting the credit limits that can take place anytime.

How Credit Card Chatbots Help Both Banks & Customers

Well-designed chatbots can be valuable tools to serve credit card customers throughout the lifecycle effectively. Not only will they contribute to customer satisfaction, but they can ensure the efficient execution of operations for banks or financial services institutions.

Reach/Awareness

The conversational interfaces (chatbots) can succinctly inform your audience during natural conversations about credit cards you offer and what benefits they bring for the customers. These bots can work with multiple channels, including websites or your apps on mobile devices. These bots can be part of your comprehensive customer service toolkit to provide a consistent experience.

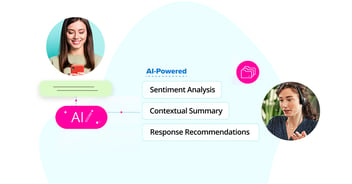

The AI technology powers the bots through natural language processing to identify the right context to introduce your credit card services without being intrusive. Possessing the capabilities of contextual conversations makes chatbots compelling for banks from a customer satisfaction point of view.

Contextual Targeting

Chatbots can gain additional intelligence by analyzing the historical data about spending habits, credit history, transaction history, and many other parameters. By leveraging the intelligence generated through such analysis, you can utilize chatbots to identify the right audience segment that can benefit from credit card products.

By addressing the customer pain points through such behavioral and contextual analysis, banks & FIs can establish a proactive conversational channel. Customers value relevant information rather than random intrusive advertisements.

Such intelligent outreach can also utilize personalization by addressing individual customers' unique needs and increasing the conversion rates for banks.

Learn more: 9 Best Chatbots in the Financial Services Industry

Acquisition

With chatbots, customers can get increasingly detailed information without too many hassles. Such data can include details about various cards, individual benefits, rewards, and eligibility, all with the natural conversational patterns. Bots can even present personalized information for individual customers to help each customer understand this information efficiently.

The proactive ease of information availability helps increase customer interest in your card product. Once the customer has all the information, they can apply for a specific card through the chat interface.

Conversion

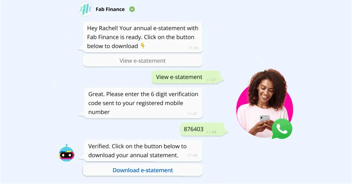

Conversion is a crucial stage from an institution's perspective as this stage must maintain a balance between customer service and operational efficiencies. Credit card chatbots ensure customer satisfaction by facilitating seamless interactions for customers. Be it uploading the documents by customers or informing them about the outcomes of each process step.

The underlying computer vision and natural language processing algorithms, along with predictive analysis and anomaly detection capabilities, find probable fraudulent documents and risky applications for better scrutiny. Of course, such capabilities rely heavily upon the algorithms having trained with large and accurate datasets. But gradually, these machine learning algorithms become more accurate through self-learning. The chatbots can act as conduits of all this information in natural ways between customers and banks.

Retention

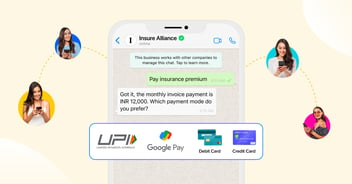

Credit card chatbots play a vital role in retention, given their capabilities to facilitate proactive interactions with customers. The bots can remind customers about their dues and enable customers to make payments against those dues.

The bots can help convey any probable fraudulent transactions flagged by the underlying algorithms. Quick identification of such transactions helps both banks and customers against threats and risks.

Through the help of predictive analysis using Machine Learning (ML) and Artificial Intelligence (AI) algorithms, the intelligence component of the credit card chatbots can identify customers with higher flight-risk. Banks can then proactively take appropriate retention measures. Proactively taking such measures helps banks ensure higher retention rates.

Advocacy/Loyalty

As the prime drivers of customer satisfaction, conversational credit card chatbots help banks inform customers about loyalty programs and their benefits. They also facilitate customers to utilize those benefits.

Based on spending patterns and payment history, bots can suggest enhanced credit limits for the customers. This way, bots become agents of growth for banks and financial institutions.

Using demographic data and credit card purchase history, credit card companies can offer targeted promotions and deals to customers digitally.

As customer satisfaction increases through such personalized, contextualized, and practice information availability, the customers, in turn, become your ambassadors, recommending your services to others.

Banks can utilize the bots to advise customers on overall financial health management. Rather than customers reading a manual or an article on money management, a chatbot providing personalized financial advice would be a great way to turn a customer into your advocate and ensure long-lasting loyalty.

Cross-Cutting Concerns

Chatbots can help customers block their lost cards and reapply for the new card. Royal Bank of Scotland's (RBS) online chatbot "Assist"– earlier called "Luvo"– is an example of how customers can report lost cards and request blocking them.

Bots can also identify non-paying customers and send them reminders about pending payments. Upon non-payment beyond a threshold, the underlying business logic can also block the card.

Banks can also enhance the effectiveness of these bots and entire operations by capturing customer feedback seamlessly.

Fraud Detection

Fraudulent transactions are a significant concern for banks and financial institutions. With bots, banks & FIs can leverage predictive analytics into their existing fraud detection workflows to reduce false positives. Underlying AI capabilities could analyze and score credit card transactions on their likelihood of being fraudulent by assigning a risk probability score, using predictive analysis or anomaly detection.

Predictive analytics algorithms do need extensive training on a large amount of data. However, the training allows the algorithm to understand an acceptable transaction versus a possible fraudulent one. Such training may also discover previously undiscovered fraud methods and start flagging more fraudulent transactions. MasterCard's "Decision Intelligence," the fraud-detection solution, is an excellent example of how the power of ML & AI can help detect and possibly prevent a fraudulent transaction.

Learn how AI Chatbot will transform the Mortgage Industry in 2021

What care should you take while using Credit Card Chatbots?

While chatbots help efficient credit card operations and higher customer satisfaction, they need careful consideration and efforts to be effective.

1. You must ensure that you have trained the bot with enough high-quality data. The ML algorithms have better accuracy if they utilize large datasets. At the same time, inaccurate data labeling may result in erroneous inferences by bots. Both of these scenarios may harm customer sentiments.

Such training also determines the questions and queries that the bot can answer. Banks should be careful about including data that represents the entire cross-section of their customer demographics and operations. For example, institutes must train the chatbots in multiple languages that their customers speak to work in a multilingual environment. While some of these requirements may not be critical, thinking about such edge cases can provide you with an edge when it comes to customer delight.

2. You should use it as another channel of communication, not the only one. Your customers should have other options to perform the same operations if they find them more comfortable. For example, many customers may prefer to communicate via email in bits and pieces. Consistent omnichannel experience is critical for better customer satisfaction.

3. Let your customers also choose to talk to a human assistant any time they want. Limiting their options to virtual assistants may prove to be counterproductive.

4. Instead of rolling-out the bot's capabilities in one go, incrementally releasing facilities help the customer better adapt to them. You can also benefit from customer feedback to provide better options for solving their acute problems. Once they see the benefits, you can then gradually roll-out increasingly complex use cases.

What are the Advantages of a Credit Card Chatbot?

A Credit Card Chatbot can benefit banking institutes in many ways, such as:

-

It can reduce the human agents' workload by automating repeated queries of the new users and customers.

-

Enable an omnichannel experience for your customers using different channels for interaction.

-

Stay available 24/7 and during peak hours to answer the repeated queries of customers.

-

It can speed up operations and reduce the cost of your operations.

-

Educate thousands of users at the same time about loyalty programs, rewards, and special offers.

Given the advantages, the use of chatbots to manage credit card lifecycles is growing fast. Bank of America, a banking and chatbot implementation leader, uses their chatbot, Erica, to serve clients with comprehensive service for their credit card transactions. Many other institutions like JPMorgan Chase and Fargo Wells are using chatbots to help their banking operations increasingly. As the market leaders see the benefits, the rest of the institutions follow the lead.

Check your credit score with this Smart Skill:

To Sum Up

With credit card chatbots, banks and financial institutions can ensure better customer interactions and get an intelligent agent contributing to business growth. These automated intelligent agents, through conversational interfaces, offer better targeting by recommending the right product to the right customers. By analyzing customers' interactions and data, banks can offer customized products to each customer via chatbots. Through personalized communication, banks can ensure better customer relations, ultimately resulting in sustained business growth, and chatbots are vital instruments for that.

.jpg?quality=low&width=352&name=blog-banner-2%20(1).jpg)

.png?quality=low&width=352&name=Untitled%20design%20(31).png)

.png?quality=low&width=352&name=LinkedIn%20(9).png)

-1.png?width=352&name=BlogHeader2%20(3)-1.png)

.png?width=352&name=image%20(18).png)

-2.png?quality=low&width=352&name=image%20(11)-2.png)

-1.jpg?width=352&name=Linkedin+%20Twitter%20(1)-1.jpg)

-1.png?width=352&name=LinkedIn%20(1)-1.png)

.png?quality=low&width=352&name=LinkedIn%20(3).png)

.jpg?width=352&name=sentiment%20(1).jpg)