FlNANCIAL LENDING

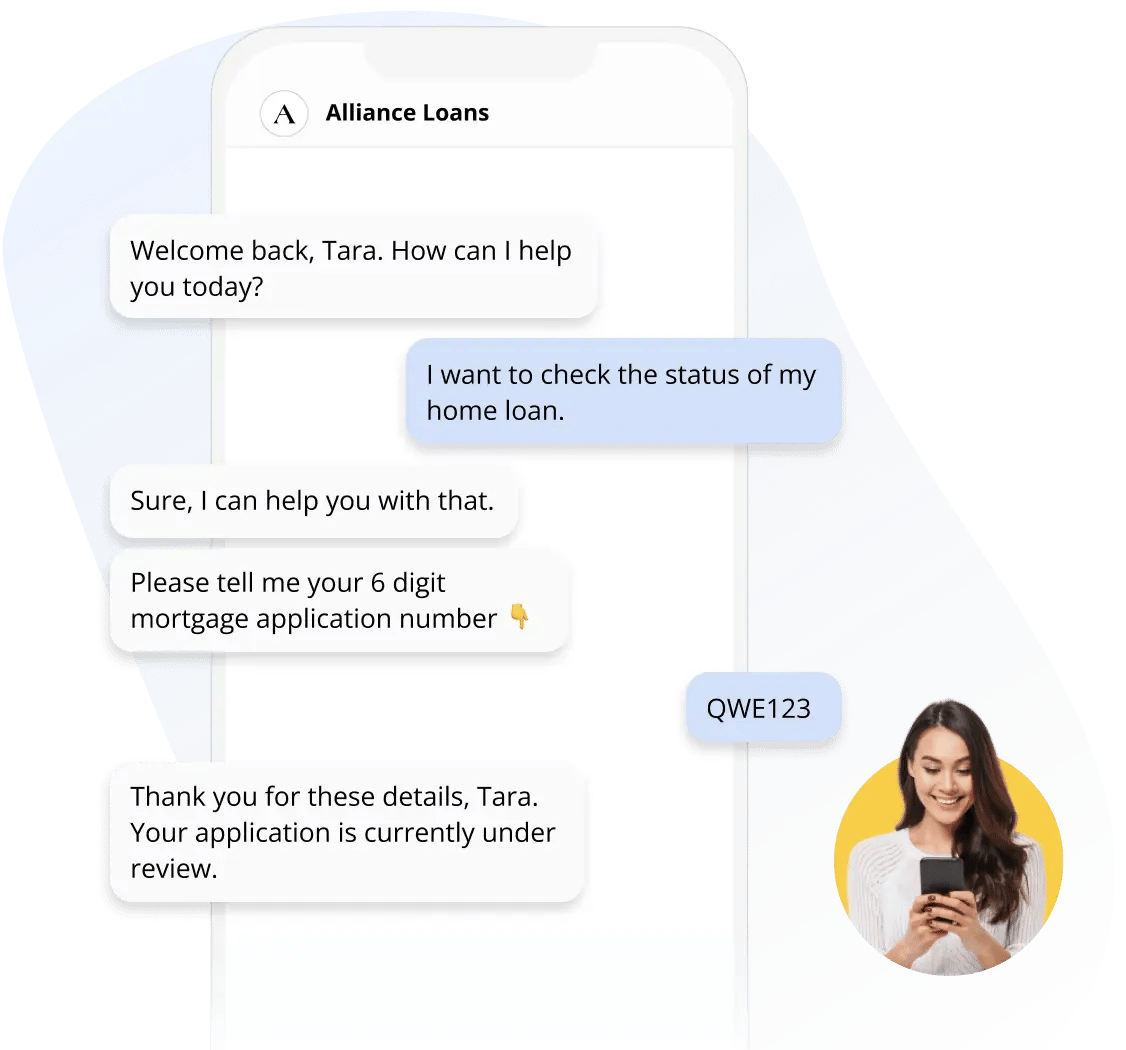

The Ultimate Lending Experience on Chat

Interact with customers on top messaging apps to create leads, streamline loan processes, and offer exceptional post-disbursement assistance.

Trusted by Leading Loan Providers

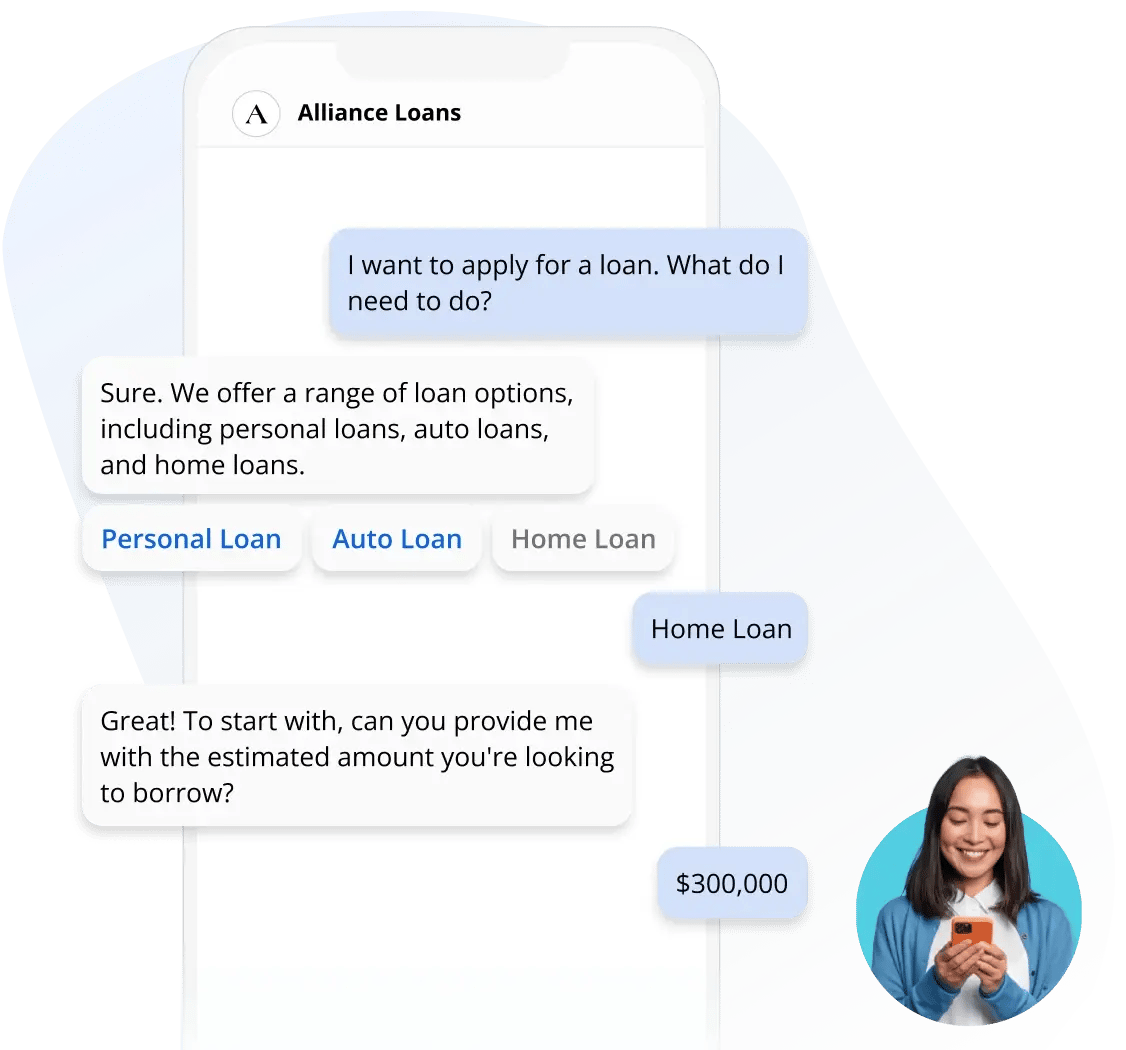

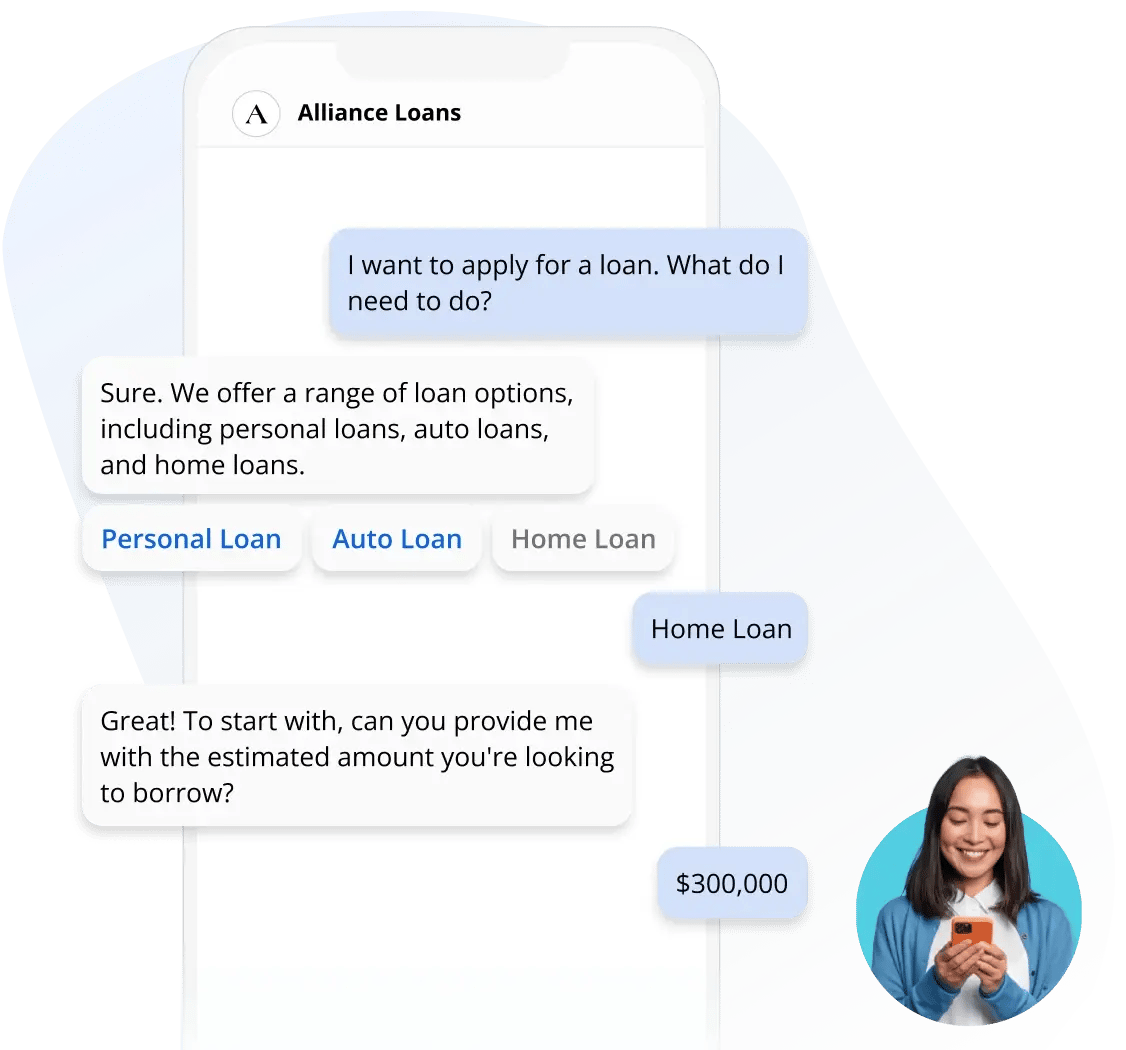

Attract High Quality Leads

-

Provide customers immediate access to a credit line without waiting or talking to a representative.

-

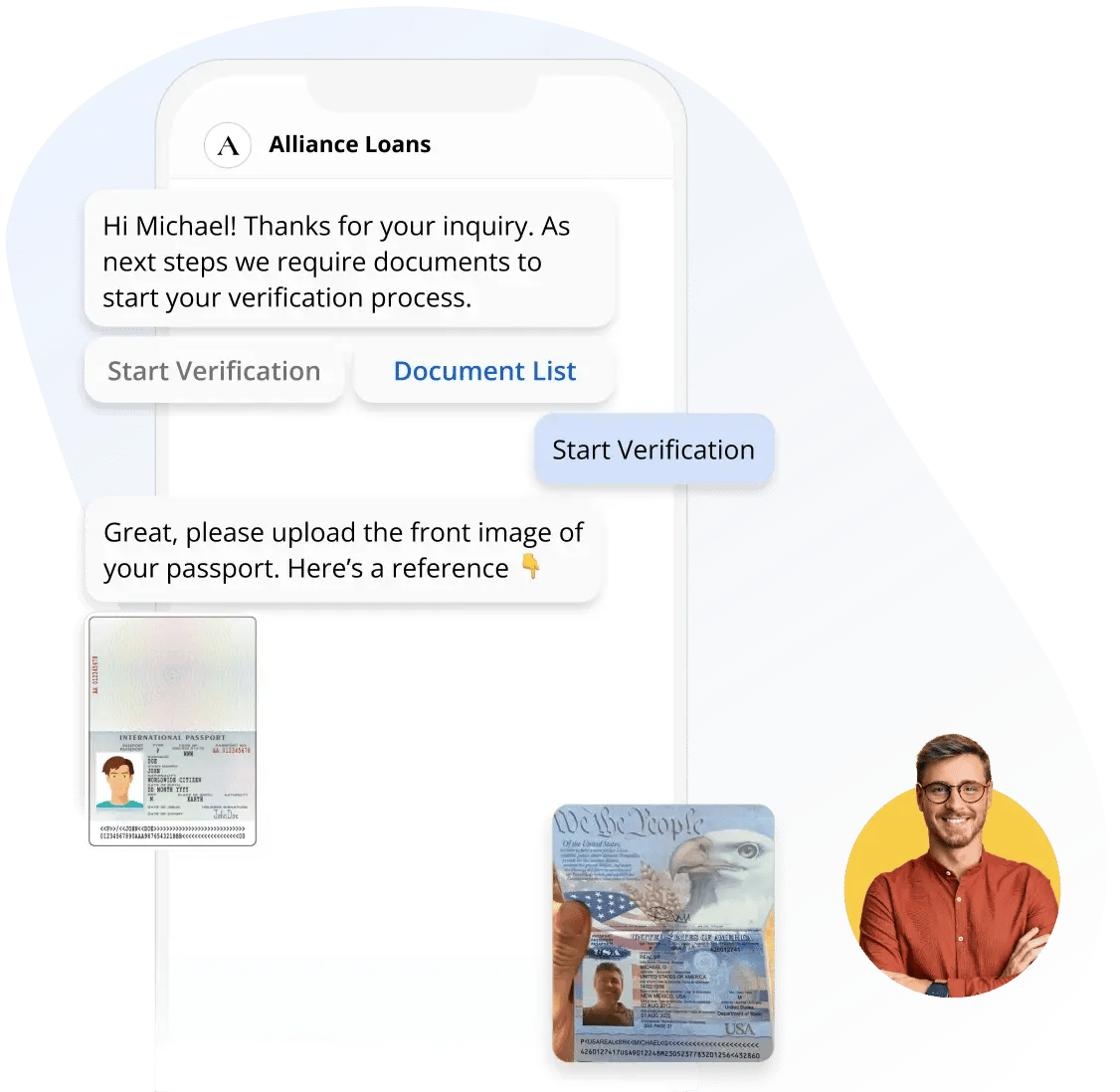

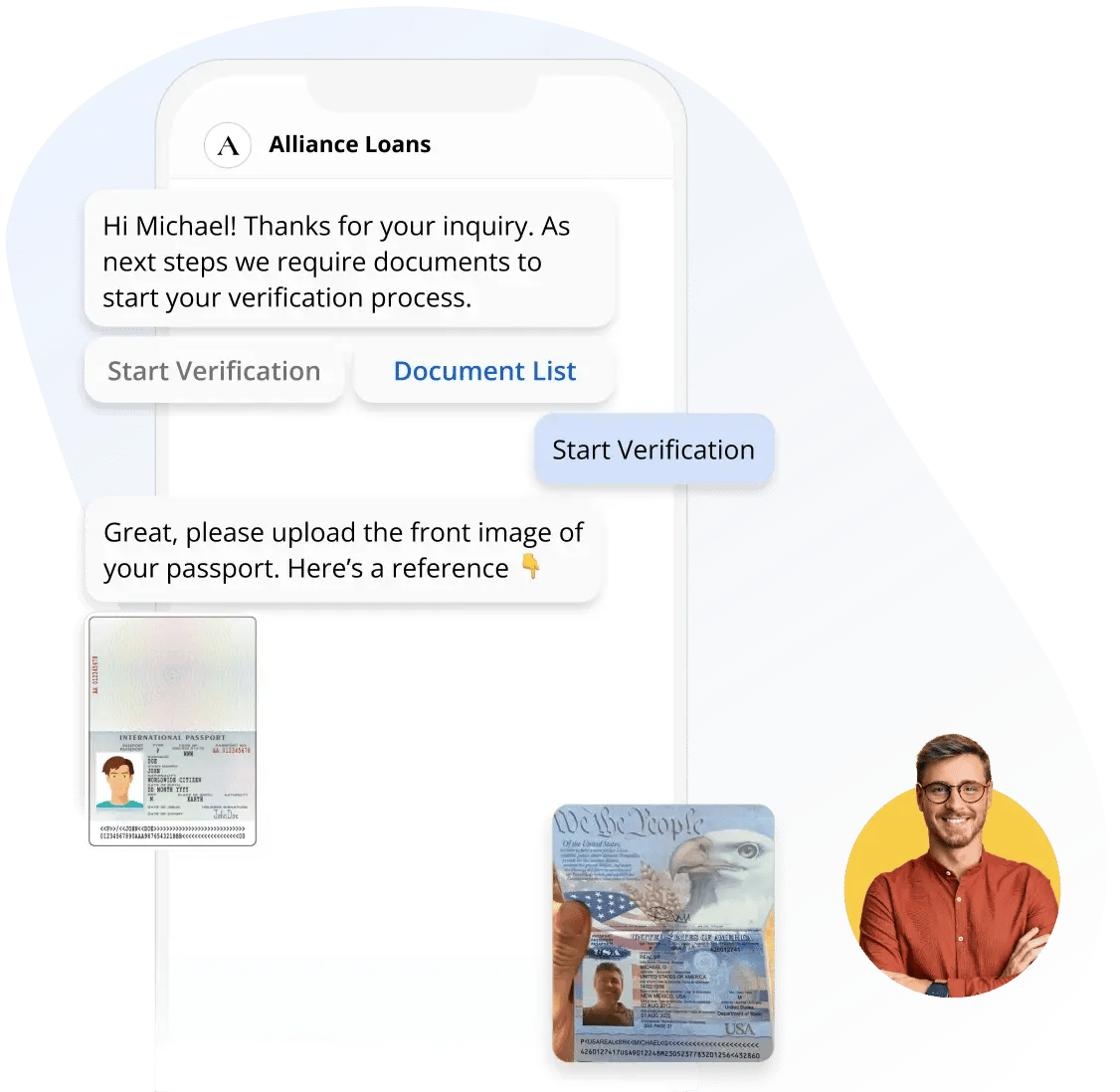

From pre-qualification to document submission, our bots make it easy for customers to complete their applications, reducing friction and increasing conversion.

-

Turn potential lost opportunities into successful conversions by proactively re-engage with dropped-off leads.

Mortgage and EMI Calculators

-

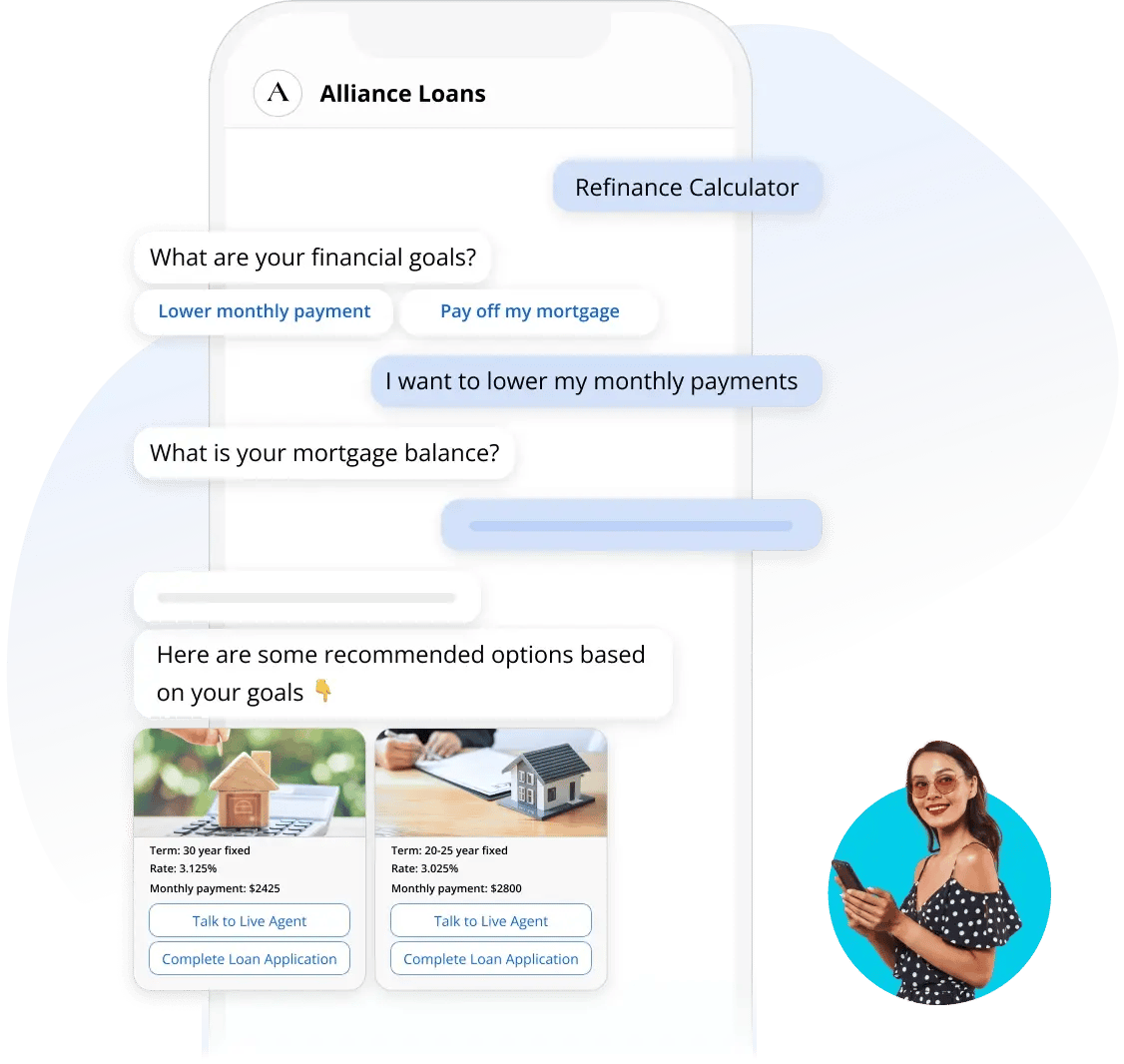

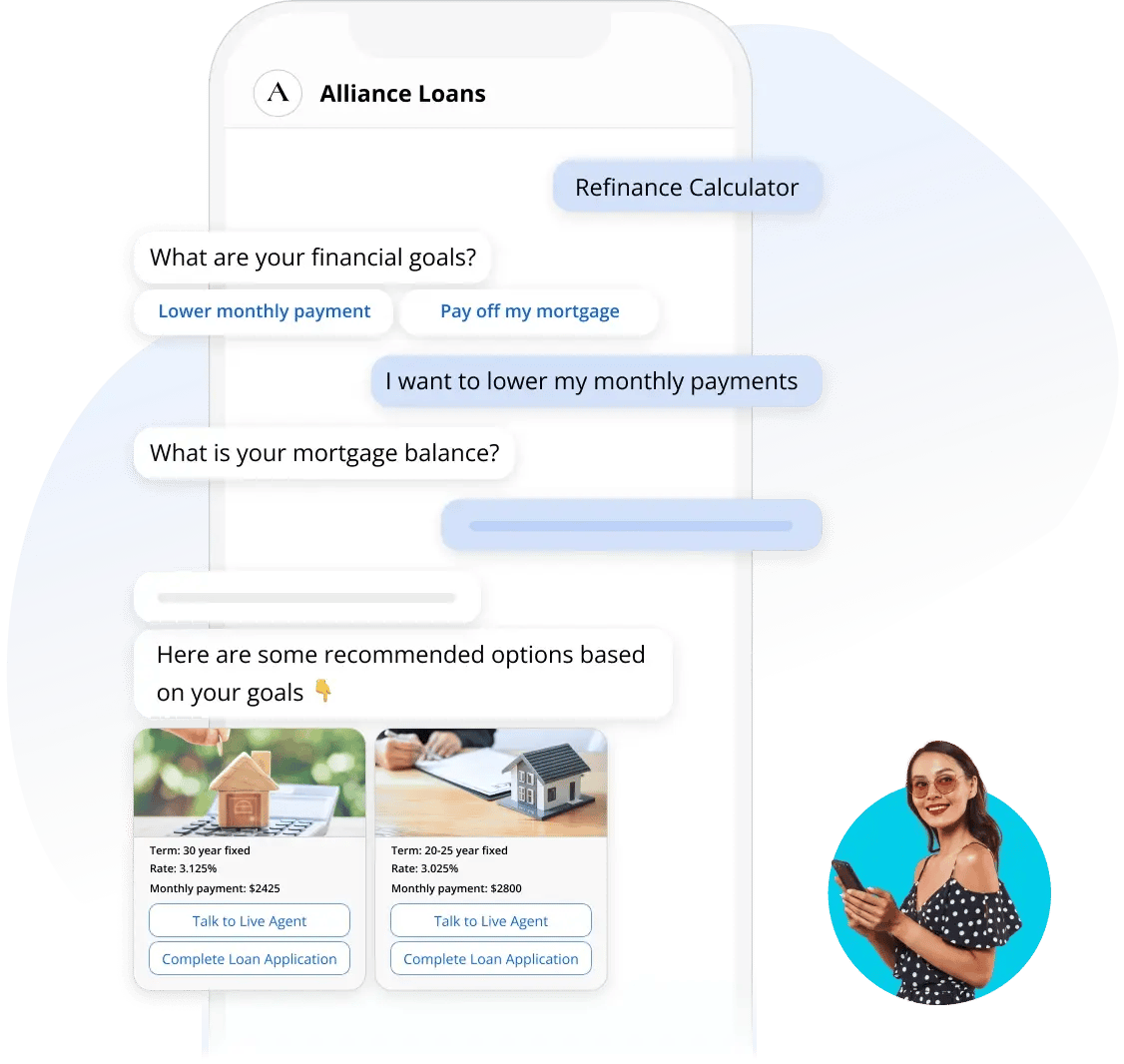

Offer customers access to mortgage and EMI calculators on chat, allowing them to make informed decisions about their loans.

-

The EMI Calculators can factor in each customer's unique financial situation, offering personalized calculations for accurate, tailor-made loan recommendations.

-

Speed up the eligibility check process with a user-friendly WhatsApp calculator for entering details and quickly receiving results.

Offer Proactive, On-Demand Support

-

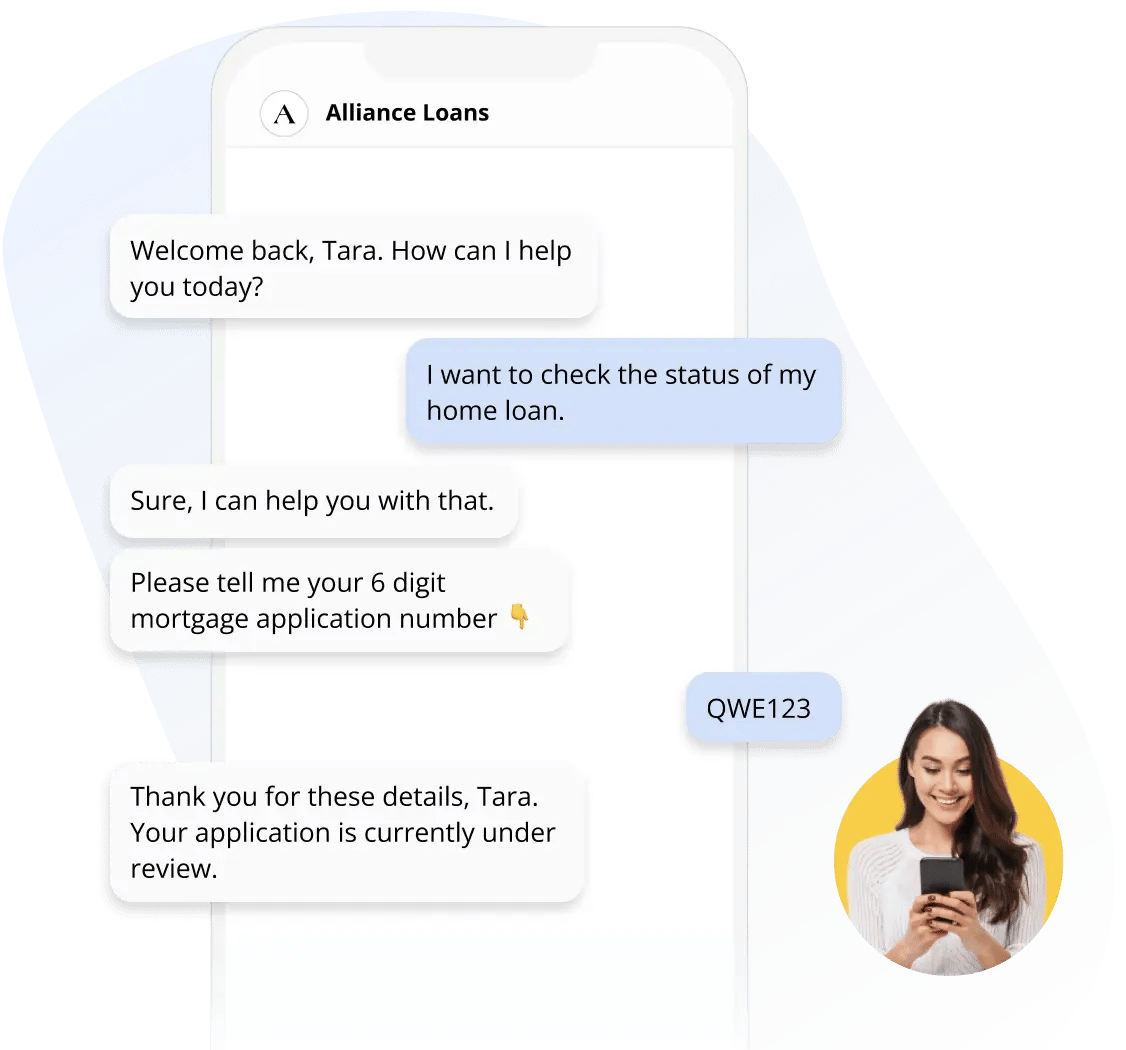

Sending timely updates and reminders to customers about their ongoing loans to keep customers informed about their loan status, payment due dates, and payment schedule.

-

Effortlessly assist customers in retrieving their active loans and associated account statements connected to their account.

-

Enable a smooth agent hand-off in real-time, helping customers speak with a human agent to clarify their key concerns.

Simplify the Lending Process

Make it seamless to apply for loans, check application status and get great post-loan support

Pre-Built Conversation Workflows

Leverage Haptik’s library of 100+ pre-built Mortgage workflows to go live faster

Send Two-Way Notifications

Proactively engage with leads and offer them the right loan options matching their requirements

Support for 130+ Languages

Cater to loan applicants and home buyers across geographies by using chatbots that support 130+ languages

Smart Agent

Routing

Escalate queries that require human involvement and offer instant support to drive higher CSAT

The Impact of Haptik’s Lending Chatbots

Offers customers an easy and hassle-free way to apply for loans.

Recommended Resources

Relevant reads for mortgage industry

.webp?width=309&height=250&name=ring-28-3-23(1).webp)