Industries across the spectrum are exploring the use of Artificial Intelligence (AI) for transformation. The mortgage industry is no exception. We explored how AI Chatbots would transform the mortgage industry in 2021. The shift, while being all-pervasive, will play a vital role in accelerating the mortgage loan process.

Effective lending and mortgage processes are vital for the economy, especially in uncertain times. The key is to make the process efficient while balancing the risks. In mortgage loan processing, several tasks are repetitive and complex. You can automate these tasks to reduce errors and improve productivity. Conversational AI can help you achieve these objectives effectively. This article will discuss how companies can use Conversational AI to accelerate mortgage loan processes effectively.

Learn how personal finance chatbots can help users redefine money management

The Mortgage Loan Process

Mortgage loans are a specialized form of secured loans in that the collateral is an asset, typically a house or similar real-estate. These loans help to buy a new residential or commercial property or even refurbish existing ones. The mortgage loan process is immensely evolved as it goes through many stages of information & documents collection, reviews, appraisals, and approvals. The amount of information exchange is also significant, with many departments and functions being part of the cycle. Given these complexities, the end-to-end process is quite time-consuming. The amount of data that the lender needs is also large, which adds to the time and increases the risk of mistakes.

Let us see the broad stages and the role each of them plays in the process.

Pre-Qualification

The process starts from pre-qualification, where the lender examines the buyers' capabilities to pay back the loan. This process decides what kind of loan product is suitable and the borrower's loan limit by reviewing their income, expenditures, assets, and liabilities. In addition to determining the borrower's ability to repay the loan, the lenders also verify the borrowers' willingness to pay back. Credit scores, which take into account both these aspects based on the borrower's repayment history, among other factors, determine the eligibility.

Loan Application

While the pre-qualification determines the overall eligibility, the application process is a specific start to the process. The borrower will provide all required documentation, including the property that will serve as the collateral.

The Loan Estimate

The lender scrutinizes the loan application. Based on the observations, the exact details, including loan amount, repayment schedule, and EMIs, are decided and conveyed to the borrower. The estimate is one of the most vital factors in the loan's approval, determining the interest rate and the amount that the borrower will need to repay.

Processing

The borrower may have received the estimates from multiple lenders. Depending upon the suitability and preferences, they decide the lender and convey the intent to proceed. At this stage, the lender obtains another set of documents.

After the lender has reviewed all documents, they might ask the borrower for clarifications and additional documentation.

Appraisal

The appraisal is the final step before the lender freezes every detail of the loan. An appraiser derives the value of the mortgaged property as part of this stage. These appraisals are essential to the mortgage loan process. It is an opinion of a property's fair market value. It is completed by a licensed professional who provides an estimate of the price at which the property would change hands between a willing buyer and a willing seller, each acting prudently and knowledgeably and assuming that neither is under undue pressure.

Underwriting

This process determines whether the mortgage loan can be finally approved or not. This process involves a series of final checks by the lender after the property's appraisal to ensure that the lender can resell it for the loan amount. The process involves reviewing the applicant's credit history and income and analyzing the property value to ensure that they can sell it for the loan amount given the sale costs.

Closing

The borrower accepts the loan, and the lender distributes the loan amount to the borrower. The closing process or the settlement is when people interested in the property transfer the property title. The closing process is the final step in the mortgage loan processing.

Challenges of the Mortgage Loan Process

The above are broad steps of a mortgage loan process. Still, each step is highly regulated, complicated, and time-consuming, with a considerable amount of exchanges between the various departments of the lender, borrowers, and third-party stakeholders. The process poses the following challenges for the lender;

-

How to minimize the time taken to complete the mortgage loan process from start to finish?

-

How to increase the pull-through rate? Pull-through rate is the ratio of the number of applications received versus the successful loan applications where the lender released the loan.

-

Reduce the rates of loan fallout and abandonment. How to ensure that every prospective applicant avails the mortgage loan?

-

How to reduce the acquisition costs for new customers? The cost of the operations is a critical concern. Manual processes require a large, skilled team to handle the workload at every stage of the process. Not having sufficient people can slow down the process and even result in the loss of potential customers.

-

How to reduce the risk of fraudulent loan applications and Non-performing Assets (NPAs)? How to qualify the applicants to ensure that only genuine and creditworthy borrowers get the loan sanction?

Each stage involves several people from multiple departments who are responsible for particular activities in the mortgage lifecycle. On top of that, the loan process involves time-consuming and repetitive tasks such as:

-

The mortgage loan processing has large application forms and other documentation. This information is required for the lender to ensure that they are dealing with a genuine borrower and meet all statutory and regulatory compliance requirements. Filing paperwork is one of the most time-consuming activities.

-

Many different departments and entities are involved in mortgage loan processing. There may be much back and forth between the borrower and the lender to ensure the lender has all the required documents to successfully approve the loan application.

-

Facilitate smooth back and forth communication with customers. As the processing requires many information exchanges, maintaining an adequate, continuous communication flow is critical for its efficiency.

-

Reviewing documents for inaccuracies or fraud is another critical aspect that affects efficiency as there are many documents to review, and any mistake can result in wrong decisions.

While the above are related to determining the borrowers' eligibility for the loan and the application-to-disbursement lifecycle efficiency, assessing the applicant's creditworthiness is equally essential. These decisions depend on multiple data points to predict the future behavior of the borrower based on past transactions. Manually determining every borrower's creditworthiness is a considerable task that makes the process vulnerable to mistakes, oversights, and even mischiefs.

How Can Conversational AI Contribute?

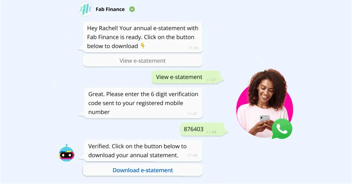

Artificial intelligence and machine learning can streamline and simplify the end-to-end process while delivering an improved consumer experience. Conversational AI, more popularly known as chatbots, can help you make the process more efficient, increase customer engagement and reduce risk from the mortgage loan process.

-

Conversational AI enables better communication and increases customer engagement and satisfaction. Through natural conversations, chatbots can engage a potential borrower and help you convince them by the easy and effective distribution of information. As the conversation takes place using the natural conversation pattern, like between two humans, borrowers find it engaging and valuable. The bots can also intelligently & seamlessly transfer the communication to a human loan expert when appropriate.

-

The AI-powered mortgage chatbots can provide personalized information across multiple channels, thus helping with increased borrower engagement. Personalized information distribution also helps move the process faster as the borrower doesn't need to sift through massive documentation and information resources to find the relevant information for them.

-

The bots can intelligently answer any borrower's queries. If necessary, it can escalate the queries to human agents who can then satisfy the borrower. As borrowers get quick access to focused information, they are more likely to make a decision faster.

-

It simplifies the application process by acquiring knowledge through natural conversation rather than tedious forms that slow down the process and may even force the borrower to abandon it. The bots can help lenders, too, by enabling automated data extraction and document classification. Such extraction and classification can reduce the total cycle time by around 96%.

-

Based on the underlying anomaly detection algorithms, the bots can identify any discrepancies in the information provided and facilitate immediate corrections.

-

By applying ML algorithms to the borrowers' data, intelligent chatbots can determine whether the borrower can be pre-qualified for the loan. These algorithms can also identify the risk factors and inform loan officers if they are significant.

-

During the processing stage, just like loan applications, the bots can ensure that all required documentation is in order. Additionally, using Computer Vision and Anomaly detection algorithms, bots can also detect fraudulent or incorrect information. They can also get the data from external credit rating agencies through integrations and API requests. Effectively trained algorithms can accurately predict each borrower's overall risk threshold, thus helping better lending decisions.

-

Based on the appraisal, the supporting AI algorithms can determine whether the loan can be sanctioned or not. It can also determine the final amount, as well as all other details of the loan. Such analysis helps the sanctioning loan officers make the right decisions.

-

The Conversational AI serves lenders and borrowers even after the loan is disbursed. It can ensure automatic reminders for repayments, answers to borrowers' queries, and even pertinent information like changes in interest rates to the borrowers proactively. Such proactive and continued interactions help the lender in upselling & cross-selling appropriately.

Cross-Cutting Concerns

-

Across all the mortgage loan processing stages, conversational AI technologies facilitate effective, natural communication with the borrower. It cuts down on the borrowers' waiting time and accelerates the information disbursal, document & information scrutiny, and loan processing. It can immediately provide answers to the borrower's queries and guide them through each step of the process without any delays.

-

Such conversations can take place 24/7 and across many channels, including web and mobile, and can use rich mediums including text, voice, images, and videos. The lender doesn't need to increase the human resources for such round-the-clock availability. The chatbots also help the lender navigate the periodic spikes and drops in demand. The omnichannel availability helps keep the borrower engaged and improves the customer experience.

-

By enabling real-time information disbursal, guiding the borrowers proactively through the process, and providing pertinent and timely information to the lenders for accurate decision-making, conversational AI helps respond to mortgage loan processing challenges.

-

CoreLogic's 2019 Mortgage Fraud Report estimated that 1 out of every 123 mortgage applications have indications of fraud. AI-powered chatbots can ensure that all documentation requirements are met and raise flags if there are any inadequacies or inaccuracies. Moreover, it can determine the risk probability and alert the lender accordingly. The underlying anomaly detection algorithms can analyze the historical data patterns to identify any significant adverse deviations in each new loan application. These insights help lending institutions make informed decisions to avoid fraud.

Here’s a simple skill to fetch Credit Score

To Sum Up

Many organizations are already utilizing the power of AI to accelerate the mortgage loan processes. Bank of America reduced the processing time to 20 days using such solutions. They also reduced the size of the forms to 10 fields from 330. The reduced hassles for the borrower helped them increase loan originations by 6 percent in a quarter.

AI can increase the profit amount per loan by improving processing times and verifications. There is so much data to review, and AI can accelerate data processing. AI can also find patterns that predict borrower behavior. It can analyze the data of thousands of borrowers and group them based on risk or profitability. According to an NBER's report, on average, lenders with such intelligent technology capabilities process mortgage applications about 20 percent faster than their traditional counterparts. McKinsey's research found out that we are on the brink of a second wave of automation and artificial intelligence emerging in the next few years. Naturally, the lenders and financial institutions who build the AI capabilities early will reap the most benefits through improved and accelerated mortgage loan processing.

Want to develop an Intelligent Virtual Assistant solution for your brand?

.png?quality=low&width=352&name=Untitled%20design%20(31).png)

.png?quality=low&width=352&name=LinkedIn%20(9).png)

-1.jpg?width=352&name=Linkedin+%20Twitter%20(1)-1.jpg)