Transformative AI agents use cases in banking, finance, and insurance are shifting how BFSI companies operate. For executives and decision-makers, understanding where and how AI agents deliver value is key to driving strategic innovation, efficiency, and better customer experiences at scale. In this article, we explore key use cases of AI agents in banking, finance, and insurance - laced with real-world examples, actionable insights, and a glimpse into the future of intelligent automation.

At Haptik, we’re helping leading BFSI brands unlock the full potential of AI agents to drive real impact across the customer journey. From automating complex workflows like loan applications and policy issuance to enhancing fraud detection and delivering personalized financial guidance, our enterprise-grade AI agents are built for scale, compliance, and effortless integration.

With secure, multilingual support and real-time decision-making capabilities, Haptik’s AI agents for banking, finance, and insurance meet rising customer expectations while setting a new standard for intelligent experiences.

RELATED: How AI Agents are Transforming Customer Experiences for Enterprises

TL;DR

AI agents in banking, finance, and insurance are automating customer service, detecting fraud, assessing credit risk, and streamlining compliance, delivering measurable gains in efficiency and customer experience. Leading organizations are integrating these agents to stay ahead in today’s evolving landscape. This article unpacks the top AI agent use cases in banking, finance, and insurance, real-world innovations, and what’s next for AI in these industries.

cashE’s Instant Credit Disbursal on WhatsApp

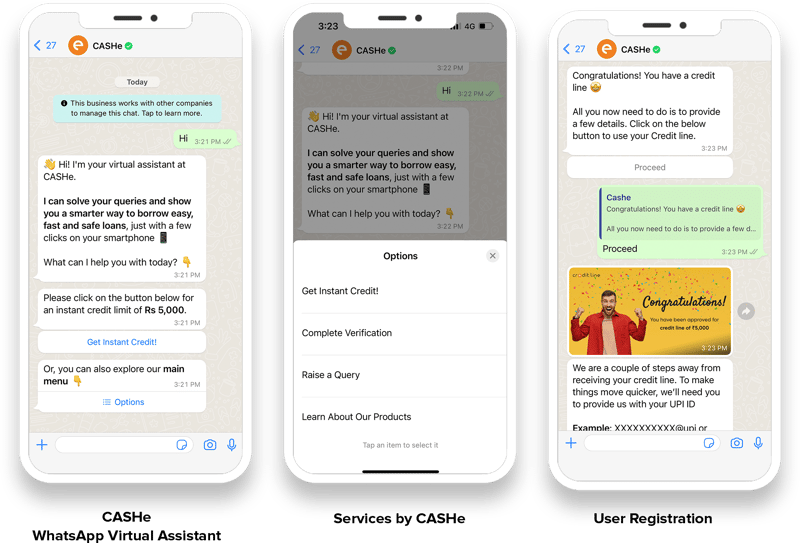

CASHe, a leading Indian digital lending platform, faced the challenge of making instant credit accessible to millions of young professionals - while minimizing manual back-and-forth, accelerating loan disbursal, and ensuring seamless user onboarding.

Partnering with Haptik, CASHe launched a conversational WhatsApp bot that automates user authentication, document upload, underwriting, and loan issuance - all within a single chat, enabling users to apply and receive credit in under a minute.

This agentic AI solution not only streamlines the entire lending process but also handles complex workflows autonomously, turning every customer interaction into a frictionless, end-to-end digital experience and making WhatsApp a top customer acquisition channel for CASHe.

Improved Efficiency and Customer Experience by Zurich Insurance

Zurich Insurance, a global insurance leader, faced mounting pressure to deliver instant, round-the-clock support to a vast and diverse customer base - especially during critical moments like accidents or illness, when timely assistance is crucial.

To address this, Haptik built Zuri, an intelligent agent that handles routine queries, guides customers through claims and policy changes, and seamlessly escalates complex issues to human experts.

This agentic AI solution enabled Zurich to automate 84% of customer interactions, boost query resolution by up to 70%, and improve engagement by 10%, proving that AI agents can transform customer service and satisfaction in the insurance sector.

Kotak Life’s Lead-Gen Campaign Using WhatsApp Flows with AI Agents

Kotak Life Insurance wanted to scale lead generation and convert customer interest into policy purchases, while reducing drop-offs and delivering a seamless experience across digital channels.

In partnership with Haptik, Kotak Life deployed an intelligent agent integrated with WhatsApp Flows, to guide users from initial engagement and to instant support and policy recommendations.

The agentic AI solution not only enabled 24/7 personalized customer interactions and a 400% boost in lead generation, but also ensured a frictionless, end-to-end digital experience. The implementation proves that AI agents can transform both engagement and conversion in the insurance sector.

WhatsApp Flows: Bringing Structure to Business-Customer Interactions

Boosting Engagement with AI-Powered Agent on WhatsApp

Upstox, Asia’s largest investment platform, faced the dual challenge of engaging a growing base of dormant users and scaling personalized support for its millions of active traders.

To address this, Haptik built an intelligent WhatsApp agent that enables seamless account activation, step-by-step guidance for trading, and instant IPO application within WhatsApp.

ALSO READ: Discover the Top 10 WhatsApp Chatbots

This agentic AI solution not only automated over 80% of routine queries and drove a 20% increase in trades through proactive messaging, but also empowered Upstox to deliver 24/7, personalized investment experiences at scale, boosting customer satisfaction by more than 50%.

Other Impactful Use Cases of AI Agents in Banking, Finance, and Insurance

The BFSI sector has come a long way through the integration of AI. What started as experimental automation and basic chatbots has evolved into sophisticated, agentic AI systems that drive core business functions, reinforce security, and deliver hyper-personalized experiences.

Today, AI agents are reshaping how banks, insurers, and financial service providers innovate, compete, and serve their customers.

Fraud Detection and Risk Management

AI agents in banking can analyze millions of transactions in real-time, detecting anomalies and preventing fraudulent transactions. They also evaluate portfolio risks and support cybersecurity efforts, safeguarding both customers and institutions.

Credit Scoring and Underwriting

AI agents streamline the credit assessment process by analyzing vast datasets, including alternate data sources, to deliver faster and more accurate lending decisions. This enables financial institutions to serve a broader range of customers, including those with thin credit histories.

You might want to read: An Expert’s Guide to Conversational AI for Financial Services

Claims Processing and Insurance Automation

AI in insurance revolutionizing claims processing - one of the most labor-intensive and customer-critical functions in insurance. By automating the First Notice of Loss (FNOL), extracting and classifying data, assessing damage, and routing claims to the right teams, AI agents remove friction and accelerate resolution.

Compliance and Regulatory Automation

AI agents are transforming compliance by continuously monitoring transactions, generating accurate regulatory reports, and ensuring institutions remain aligned with ever-changing regulations.

RELATED: A Guide to Responsible AI Practices for Enterprise AI Agent Deployment

These agents automate routine compliance tasks like tracking suspicious activity, validating data, and updating internal policies - which drive significant reductions in manual workloads and regulatory breaches.

Financial Forecasting and Investment Advisory

As financial institutions step up to deliver smarter, faster, and more personalized investment guidance, AI agents are stepping in as intelligent advisors. They process real-time market data, customer behavior, macroeconomic signs, and even general sentiment to forecast trends and offer actionable insights.

Final Thoughts

Looking ahead, the BFSI sector is poised for even greater transformation. AI agents will drive deeper personalization, proactive risk management, and seamless omnichannel experiences, setting new standards for customer engagement and operational excellence. The most successful institutions will be those that embrace this shift, fostering a culture of innovation where technology and human expertise work hand in hand.

In a world where change is the only constant, the impactful role of agentic AI in banking, finance, and insurance companies to stay competitive, resilient, and customer-centric in an era of rapid digital evolution. The age of agentic AI in BFSI has arrived and the future belongs to those ready to lead the way.